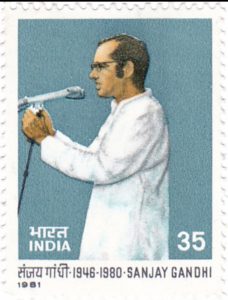

How R.K. Talwar’s Defiance of Sanjay Gandhi Changed India’s Banking System Forever.The Untold Story That Changed Indian Banking.  Explore the historic clash between Sanjay Gandhi and SBI Chairman R.K. Talwar in the 1970s and how it permanently altered banking independence in India.

Explore the historic clash between Sanjay Gandhi and SBI Chairman R.K. Talwar in the 1970s and how it permanently altered banking independence in India.

Introduction

India’s banking system has long been regarded as a pillar of economic stability and development. However, its journey has not been free from political influence. One of the most defining episodes in this history occurred during the 1970s, when a confrontation between Sanjay Gandhi and R.K. Talwar, the then Chairman of the State Bank of India (SBI), exposed the fragile boundary between political authority and institutional independence. This episode not only ended the career of a principled banker but also reshaped the governance structure of India’s largest public sector bank.

Political Backdrop of the 1970s

The early 1970s were marked by increasing centralization of power in India. Sanjay Gandhi, despite holding no elected office, exercised significant influence over policy decisions, industrial affairs, and administrative actions. The declaration of the Emergency in 1975 further weakened democratic institutions, placing unprecedented power in the hands of the executive.

Public sector banks, nationalized in 1969 to serve developmental goals, were expected to align closely with government priorities. Yet, they were also meant to function on professional banking principles. This inherent contradiction set the stage for the conflict that followed.

Who Was R.K. Talwar?

R.K. Talwar was appointed Chairman of the State Bank of India in 1969. A career banker with a reputation for discipline and integrity, Talwar played a key role in strengthening SBI’s internal systems during the post-nationalization phase. His leadership emphasized risk assessment, governance standards, and accountability—values that were critical for a rapidly expanding public sector bank.

Talwar firmly believed that political considerations should not dictate banking decisions, particularly when public money was involved.

The Loan Dispute at the Heart of the Conflict

The confrontation arose when a financially distressed industrial company, linked to Sanjay Gandhi’s business interests, sought loan restructuring from SBI. After careful evaluation, the bank agreed to consider assistance but imposed a standard condition: the replacement of the existing management to protect the bank’s financial exposure.

Such conditions were routine in cases of stressed assets. However, the insistence on managerial change was perceived as a direct challenge to political authority. Pressure mounted on Talwar through senior officials and intermediaries to approve the loan unconditionally.

Refusal, Retaliation, and the SBI Act Amendment

R.K. Talwar refused to compromise. He maintained that bending rules for political convenience would undermine the credibility of the banking system. His resistance proved costly.

In 1976, the government amended the State Bank of India Act, granting itself the power to remove the chairman and senior executives. This legal change eliminated the statutory protection that had previously shielded SBI’s leadership from political retaliation. Shortly thereafter, Talwar was placed on extended leave and effectively removed from office.

The amendment became a turning point in the governance of public sector banks.

Long-Term Impact on Indian Banking

The removal of R.K. Talwar sent a chilling message across the financial sector. Bank executives became increasingly cautious about resisting political pressure. Over time, critics argue, this erosion of autonomy contributed to weakened credit discipline and politically influenced lending decisions.

The episode is now widely viewed as an early warning sign of systemic governance challenges that later surfaced in the form of rising non-performing assets and institutional inefficiencies.

R.K. Talwar’s Enduring Legacy

Despite his removal, Talwar’s reputation remained intact. He later documented his experiences, offering rare insights into the inner workings of power and governance during the Emergency era. Today, he is remembered as a symbol of ethical leadership and professional courage.

His stand continues to be cited in debates on banking reforms, regulatory independence, and the need to insulate financial institutions from political interference.

Timeline of Key Events

1969: R.K. Talwar appointed Chairman of SBI following bank nationalization

Early 1970s: Loan restructuring dispute involving a politically connected company

1975: Emergency declared in India

1976: Amendment to the SBI Act grants government removal powers

1976: R.K. Talwar removed from the position of SBI Chairman

Post-1976: Increased political control over public sector bank leadership

Frequently Asked Questions (FAQs)

Why is the Sanjay Gandhi–R.K. Talwar episode important?

It marked a decisive shift in the balance between political power and banking autonomy in India, setting a precedent for government control over public sector banks.

Was R.K. Talwar accused of wrongdoing?

No. Talwar was removed not for misconduct but for refusing to override banking norms under political pressure.

What was the SBI Act amendment of 1976?

The amendment allowed the central government to remove the SBI Chairman and senior executives, reducing institutional independence.

How did this affect public sector banks later?

It discouraged resistance to political influence and weakened governance safeguards within banks.

Conclusion

The clash between Sanjay Gandhi and R.K. Talwar was not merely an administrative dispute—it was a defining moment in India’s institutional history. It revealed how vulnerable professional governance can be when confronted with unchecked political power. Talwar’s refusal to compromise banking principles came at a high personal cost, but his legacy endures as a benchmark of integrity.

Decades later, as India continues to debate reforms in banking and governance, this episode serves as a powerful reminder: strong institutions depend not just on laws, but on individuals willing to defend them